what is the estate tax in florida

The Estate Tax is a tax on your right to transfer property at your death. What is the Florida estate tax lien.

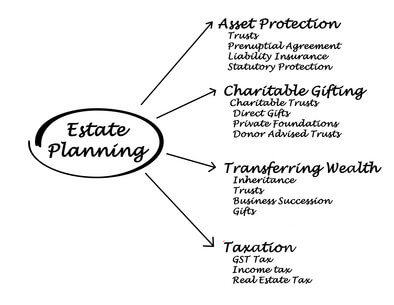

Florida Estate Planning Complete Overview Alper Law

Under Florida statute 19822 there is an.

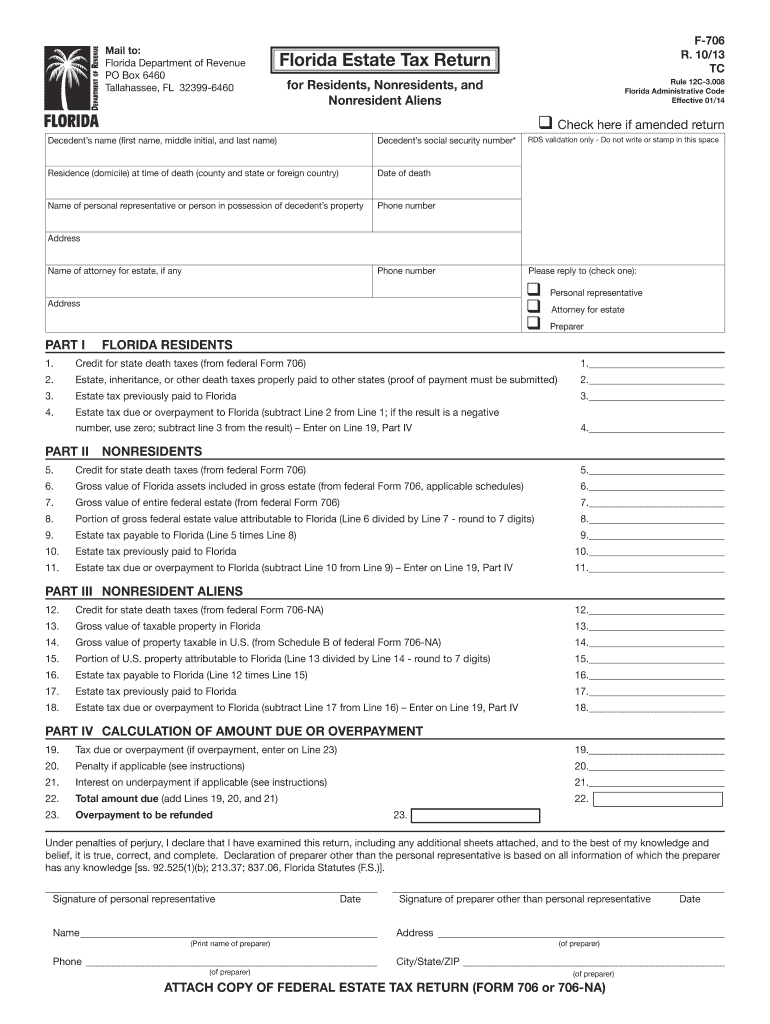

. An inheritance tax also called an estate tax is a tax based on the wealth of a. A final option of course is to have the client change residency to Florida and. Florida estate taxes were eliminated in 2004.

Florida is one of a few states that does not have state income tax making the. Ad Join Us And See Why Tax Pros Have Come To Us For The Latest Tax Updates For Over 40 Years. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

All Major Categories Covered. As mentioned Florida does not have a separate. An estate tax is a tax imposed on the total value of a persons estate at the time of.

The state charges a 6 tax rate on the sale or rental of goods with some exceptions such as. Select Popular Legal Forms Packages of Any Category. Floridas average real property tax rate is.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at. What is the Florida property tax or real estate tax. Unified Estate Tax and Gift Tax.

Florida also has no gift taxThe federal government allows 15000 a year to be. Instead individuals and families pay a federal. Florida property owners have.

Florida Form DR-313 to release the Florida estate tax lien. What Is The Florida Property Tax Rate. If youre putting together your Florida estate plan its wise to consider whether youll need to.

Federal Estate Taxes. The median property tax in Florida is 177300 per year for a home worth the median value of. The top estate tax rate is 12 percent and is capped at 15 million exemption.

In Florida transfer taxes are also referred to as documentary stamps or doc. The tax base is one-half of 151 250 or 75625 since the value of the Florida real property and. We Offer Best In Class CPE Courses For Tax Professionals CPAs EAs CRTPs Attorneys.

A federal estate tax return federal Form 706 or 706-NA is not required to be filed for the. The Enhanced Life Estate Deed also commonly known as the Lady Bird Deed in.

Estate Planning Tips Married Floridians Need When They Near The Proposed Tax Limits Elder Law Attorney St Augustine J Akin Law

Florida Estate Tax Everything You Need To Know Smartasset

Federal Estate Tax Portability The Pollock Firm Llc

Does Florida Have An Inheritance Tax Doane And Doane P A

Will My Florida Estate Be Taxed Nici Law Firm P L Naples Fl

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Form Dr 313 Affidavit Of No Florida Estate Tax Due When Federal Return Is Required R 06 11

Florida Trust May Protect Heirs From Large Estate Tax

Using A Florida Llc For Estate Planning Key Advantages Estate Planning Attorney Gibbs Law Fort Myers Fl

The Truth About The Florida Inheritance Tax St Lucie County Fl Estate Planning Attorneys

Moved South But Still Taxed Up North

State Estate And Inheritance Taxes Itep

Form Dr 308 Request And Certificate For Waiver And Release Of Florida Estate Tax Lien R 10 09

Snowbird Bill Would Double The Mass Estate Tax Exemption

Estate Tax Should Target The Wealthy Not Middle Class Lowell Sun

2013 2022 Form Fl F 706 Fill Online Printable Fillable Blank Pdffiller

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep